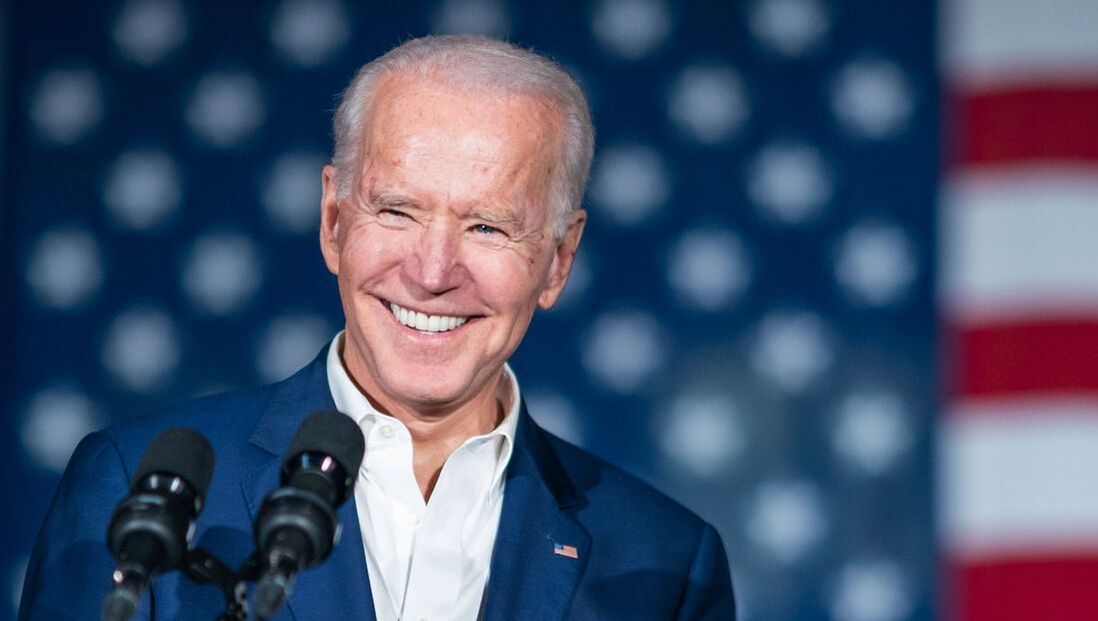

As a result, the federal government continues to provide assistance through numerous pieces of COVID-19-centered legislation—many of which impact the workplace. Read on to learn more about the Emergency Paid Sick Leave Act, the Emergency Family and Medical Leave Expansion Act, and the American Rescue Act of 2021.

Families First Coronavirus Response Act

The FFCRA provided small and midsize employers refundable tax credits to reimburse them for the cost of providing their employees paid sick and family leave related to COVID-19. Businesses with fewer than 500 employees received funds to provide the leave.

The EPSLA provided for two weeks (up to 80 hours) of paid sick leave at the employee’s regular rate of pay to some workers who contracted COVID-19 or were directed by a health authority to quarantine and provided two weeks of paid sick leave at two-thirds the employee’s regular rate of pay for employees taking care of a sick, quarantined, or displaced family member (such as children whose schools or daycare centers have closed).

Emergency Family and Medical Leave Expansion Act

The EFMLEA required covered employers (those with fewer than 500 employees) to pay employees up to an additional ten weeks of paid expanded family and medical leave at two-thirds the employee’s regular rate of pay where an employee was taking care of a child whose school or child care provider was unavailable because of COVID-19.

However, the FFCRA’s paid leave provisions expired on December 31, 2020 and the stimulus measure signed into law on December 27, 2020 omitted the paid sick and family leave mandates. The new bill did, however, continue the refundable tax credit to subsidize the cost to businesses if they provide paid sick and family leave until March 31, 2021, so employers who voluntarily provide emergency paid leave could continue claiming the tax credit equal to 100 percent of the cost of the paid leave through March.

The American Rescue Plan of 2021

The ARPA also expanded the list of reasons for which employees may take EPSL leave, including to get a vaccine, to recover from adverse effects of the vaccine, and while awaiting results of a COVID-19 diagnosis or test. Likewise, it expanded the EFMLA to allow employees to use EFMLA leave for any reason they are entitled to take EPSL leave. Unlike the original EFMLA, the entire 12 weeks of EFMLA is now paid, at a rate of two-thirds of the employee’s regular rate, up to $200 per day.

It is important to note, however, that the ARPA does not require employers to provide leave, but gives them the option and provides tax credits to those who choose to provide such leave.

Have you had trouble acquiring paid leave?

Curious if the EPSLA, EFMLA or ARPA applies to you?

RSS Feed

RSS Feed